Get a better home loan, with Mortgage Brokers Gold Coast

Are you buying a Gold Coast home, investment property or refinancing? Our experts can help you get a better loan than going directly to a bank.

Contact mortgage brokers Gold Coast here or call us on 📞 0401 022 182

We'll find you a better home loan, from 60+ leading lenders.

When it comes to your home loan, there is no such thing as one-size-fits-all. You need to shop around, and you need to understand the fine-print (a big part).

Our brokers negotiate with 60+ lenders to find the best loan options for your needs, and importantly, help ensure you're not trapped with the wrong loan for you. Just get in touch!

Glowing 5-star Google reviews, and our services are 100% free!

Loved by thousands of locals, we have access to over 2,500 loan products and will negotiate the best deals & terms for you. Here's how it works:

⓵ Get in touch, even if you've just a question

⓶ We'll get to know more about your goals

⓷ We negotiate with 60+ leading lenders for you

⓸ You choose the options, you're in control!

⓹ No costs or commitments, ever

Get in touch!

Send us a quick message & we'll be in touch!

Thank you for contacting us, our local home loan team are here to help, and will get back to you as soon as possible!

Oops, there was an error sending your message. Please check your details are correct, and if still not working please just call us on 0401 022 182

How can we help?

Big or small loan, simply get in touch if you need help with:

- Fast pre-approvals

- First home loans & grants

- Changing homes

- Investment loans

- Self-employed loans

- Construction loans

- Refinancing & more!

Please just call us on 📞 0401 022 182 or send us a quick message, we're here to help!

Glowing 5-star Google reviews.

We're loved by thousands of locals!

Our Mortgage Brokers Gold Coast specialise in:

First Home Buyers

Our Mortgage Broker Gold Coast team help make the entire process easier and hassle-free for first home buyers.

Changing Homes

Upgrading, downgrading or side-grading homes and need help? Our Home Loan Broker Gold Coast team can help!

Home Refinancing

Need better rates or have a change in circumstances? Our Home Loan Advisors Gold Coast team are the experts.

Construction Financing

Construction projects can present many challenges. Our Gold Coast team help remove the financial unknowns.

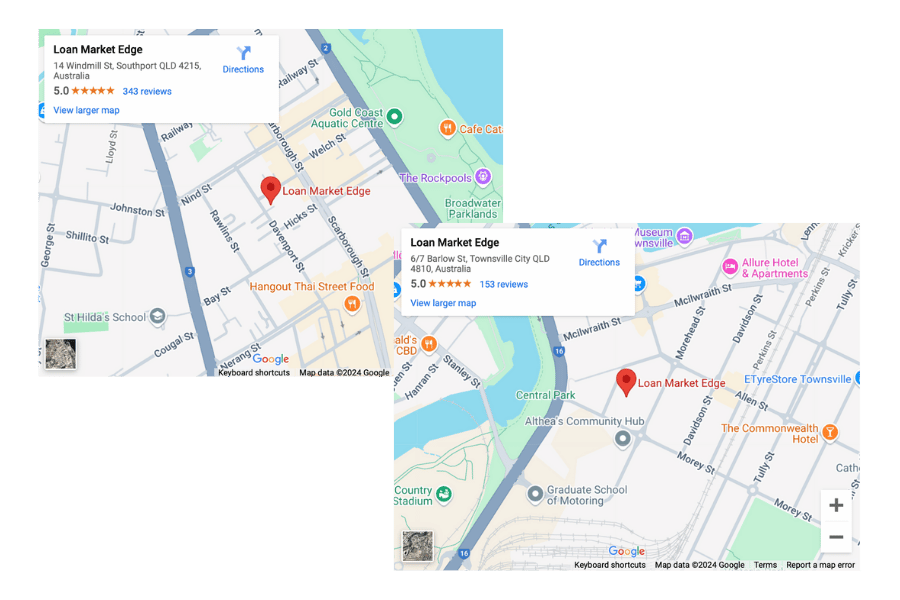

Prefer to visit us at our offices?

Dropping in for a cup of coffee can always help to get to know our local mortgage brokers a little better, or we can meet at a coffee shop near you.

These are our offices:

14 Windmill St, Southport QLD 421

6/7 Barlow St, South Townsville QLD 4810

Let's make a time 📞 0401 022 182

-

How can our local Gold Coast Mortgage Brokers help you?

Our experienced team of Gold Coast mortgage brokers is here to provide personalised service for all your lending needs.

From your initial consultation, pre-approval to loan approval and settlement, we guide you every step of the way, ensuring a smooth process focused on client satisfaction.

Here’s how we help, and why 70% of Australians now choose a mortgage broker over going directly to a bank!

1. Mortgage Solution Assessments

Our knowledgeable Gold Coast mortgage brokers assist you in finding the right mortgage solutions for your unique financial situation and goals.

Whether you’re a first-time homebuyer needing guidance, looking to buy investment property in QLD, or refinancing, we help you understand your borrowing capacity, evaluate loan options, and select suitable products from our extensive network of lenders, including major banks, boutique lenders, and online options.

2. The Home Loan Pre-Approval Process

Our experienced mortgage brokers guide you through the pre-approval process with ease, and without any confusing financial jargon.

Working with a range of lenders, from major banks like CBA and Westpac to 2nd tier lenders and credit unions, we help you get a clear idea of your budget and cash flow.

Our non-affiliated mortgage brokers work for you, not the banks, finding competitive rates and tailored solutions that fit your lifestyle and guiding you through the complex loan application process.

We can even help you find a financial planner and even a local Gold Coast real estate agents too if you need them to understand what kind of home you are looking to buy prior to pre-approval.

3. Gold Coast Property Market Knowledge

Our expert mortgage brokers are locals too! We have extensive knowledge of the Gold Coast property market, from the beautiful beaches Burleigh Heads, Mermaid Beach to Southport, Ormeau and beyond, to help you make informed real estate decisions.

With insights into capital growth, median house prices, and local amenities, we maximise your investment potential across the beautiful beachside suburbs and stunning hinterland areas, like Reedy Creek and Sanctuary Cove.

4. Home Loan Comparison Shopping

A major part of the mortgage process, is finding the right terms and rates for your needs.

At LM Edge we compare a wide range of loan products across our lender panel, which includes over 60 major and boutique lenders.

This allows us to secure the lowest rate and best terms for your loan requirements. From fixed and variable rate options to SMSF loans and personal loans, our extensive knowledge ensures we find the perfect fit for your needs. Get in touch to experience our class service and see why we have 300+ Google reviews.

5. Paperwork and Application Help

Our LM Edge team simplifies the paperwork by guiding you from application to settlement.

We assist with everything from first home owner grants, identification verification to submission, ensuring details are accurate to expedite approval, even for poor credit loans or urgent approvals.

With our understanding of each lender’s commission schedule and bank application requirements, we make your loan application process stress-free for all of our clients.

6. We Simplify The Home Loan Process

Buying a home can be overwhelming, especially with financial commitments, borrowing restrictions, and bank requirements.

With our local knowledge and connections, our team of expert mortgage brokers streamline the entire loan process - from application to settlement process.

We also provide credit advice to annual reviews, ensuring you have a seamless mortgage experience tailored to your current and future financial needs.

7. Ongoing Mortgage Support

We offer ongoing support with annual reviews, helping you adjust loan solutions to reflect changes in your financial situation or market conditions.

At LM Edge our commitment to client satisfaction includes access to online loan calculators, assistance with debt consolidation, and cash rate hike updates, keeping you financially informed. We’re here for you long after settlement to ensure your financial future aligns with your goals.

For all your mortgage needs in Gold Coast, call us on ☎️ (07) 4721 4772!

-

Who do we help on the Gold Coast?

First Home Buyers Gold Coast

With a focus on clear communication and friendly service, we guide first home buyers through pre-approvals, first home owner grant QLD, loan comparisons, and documentation for a smooth loan application - to help you get into your first home without home loan stress.

Changing Homes

From Gold Coast Self Employed and Gold Coast Business owners, employed people and even soon to be retirees looking for a self-managed super fund loan, our mortgage brokers make the transition to your new home stress-free, handling rate negotiations and lender options, so you can focus on the excitement of your new property.

Gold Coast Property Investors

For investment loans, we understand the importance of cash flow and capital growth. Our insights into the Gold Coast market and range of loan products empower investors to make wise decisions.

Gold Coast Locals Who Are Refinancing

Refinancing with us gives you access to competitive rates and expert advice on how refinancing might impact your cash flow, debt costs, and overall financial plan.

Gold Coast Construction Loans

Building a new property or renovating? Our team’s knowledge of construction loan options ensures your project is financially sound from start to finish, minimising stress.

Simply get in touch with us today on ☎️ (07) 4721 4772 if you’ve any questions or looking for the best Mortgage Brokers Gold Coast!

-

Why is the Gold Coast 4217 a great place to buy a home or investment property?

Here are seven reasons why the Gold Coast 4217 area, including places like Surfers Paradise and Main Beach, is an excellent choice for buying a home or investment property:

1. Rapid Property Value Growth

Gold Coast property values have appreciated considerably in recent years. The 4217 postcode has seen robust growth due to high demand, population influx, and infrastructure investment, making it an attractive location for capital gains.

2. Strong Rental Yields

The Gold Coast offers competitive rental yields, especially in suburbs like Surfers Paradise. Investors can enjoy solid weekly rental income from properties, driven by the high demand for rentals in this popular destination.

3. Consistent Tourist Demand

As a famous tourist destination, the area benefits from consistent tourism demand, boosting the short-term rental market. This appeal translates to increased occupancy rates for holiday rentals and potential income growth for investors.

4. Low Vacancy Rates

With vacancy rates under 2% in areas like Surfers Paradise and Main Beach, rental properties are highly sought after, ensuring steady tenant interest. This low vacancy is a positive indicator of high demand, providing more stability for investors.

5. Extensive Infrastructure Development

The Gold Coast is undergoing significant infrastructure enhancements, such as the light rail extension and improved highway connections. These projects make the area more accessible, increasing property desirability and long-term growth potential.

6. Lifestyle Appeal and Amenities

4217 is synonymous with a vibrant lifestyle, offering world-class beaches, diverse dining, entertainment options, and a variety of recreational activities. This coastal lifestyle is appealing to both renters and homeowners, adding long-term value to properties.

7. Future Growth Potential

As a city with ongoing development plans and a steady population increase, the Gold Coast promises sustained growth potential. This future growth is supported by government initiatives, which continue to attract residents, investors, and businesses to the area.

Simply get in touch with us today on ☎️ (07) 4721 4772 if you’ve any questions or looking for the best Mortgage Brokers Gold Coast!

-

Who are the major banks and home loan lenders in the Gold Coast 4217 area?

Below is a list of local banks, online lenders and other brokers that help clients on the Gold Coast. We work with most if these lenders!!

So if you are looking for home loan help, we can get the best rates and terms around, simply get in touch with us on (07) 4721 4772.

Gold Coast Major Banks

Commonwealth Bank, ANZ, Westpac, and NAB are top choices for traditional banking. However, as independent mortgage brokers, we compare options across these and other banks for the best deal.

Non-Bank Lenders

Options like Macquarie Bank and ME Bank offer unique loan products. We compare these with others to secure the best terms.

Other Mortgage Brokers on the Gold Coast

Local Gold Coast mortgage brokers such as Mortgage Choice, Loan Market, and Infinity Group Australia provide alternative options, but our team’s expertise and unbiased advice stand out.

Ready to discuss your loan options? Contact us on ☎️ (07) 4721 4772 to connect with a Gold Coast Mortgage Broker who’ll support you throughout your financial journey.

Get the home loan you need

We'll find you the best loan options.

CONTACT US

Call us today on 📞 0401 022 182

We're Mortgage Broker Gold Coast, your local Home Loan Broker and part of the Loan Market Edge team.

See our 350+ Google reviews!

Find our offices on Google Maps:

14 Windmill St, Southport QLD 4215

HANDY LINKS

POPULAR SUBURBS

All Rights Reserved. SEO by Copyburst