Mortgage Broker Oxenford

Researching Oxenford Home Loans? Our local experts can help.

Our local Oxenford

mortgage brokers can help you secure your next home loan, investment loan or refinancing.

What kind of Oxenford home loan are you researching?

First Home Loans

Our Mortgage Broker Oxenford team help make the entire process easier and hassle-free for first home buyers.

Changing Homes

Upgrading, downgrading or side-grading homes and need help? Our Home Loan Broker Oxenford team can help!

Home Refinancing

Need better rates or have a change in circumstances? Our Home Loan Advisors Oxenford team are the experts.

Construction Financing

Construction projects can present many challenges. Our Oxenford team help remove the financial unknowns.

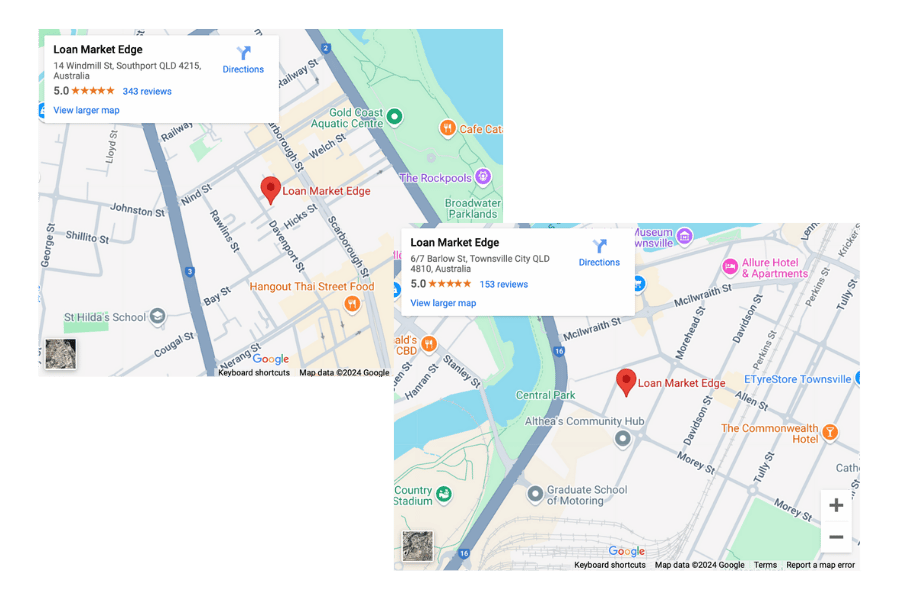

This website is run by much loved Gold Coast brokers.

If you researching home loans but need some help, please just reach out. Our offices are below, if you would rather visit us in person please just call to book a time!

These are our offices:

14 Windmill St, Southport QLD 421

6/7 Barlow St, South Townsville QLD 4810

Let's make a time 📞 07 4721 4772

How do our local Mortgage Broker Oxenford team help?

Our experienced team of Oxenford mortgage brokers is here to help you save on your home loan and provide personalised service for all your lending needs.

From pre-approval to settlement and even loan refinancing, we guide you every step of the way, ensuring you've got a smooth process that puts you first.

Here's how we help and why 70% of Australians now choose a mortgage broker like LM Edge over going directly to a bank!

1. Financial Assessment:

Mortgage brokers generally start by assessing your financial situation, which can be invaluable for first-time home buyers and Oxenford locals who may not have looked at their home loans for some time. This includes analysing your income, expenses, credit history, and overall finances to work out how much you can afford to borrow within the various loan types available.

2. Pre-Approval Process:

Brokers like LM Edge can help first, or fifth home buyers get pre-approved for a mortgage, and understand every loan process step. This involves working with lenders to obtain a conditional approval for a loan amount, which can give you a clearer idea of their budget when house hunting.

3. Market Knowledge: Local mortgage brokers often have a good understanding of the real estate market in Oxenford. We can provide insights into property values, trends, and neighbourhoods, helping buyers make informed decisions.

4. Loan Options: Mortgage brokers can present various loan options available from different lenders. We can explain the terms, interest rates, and features of each loan, helping first-home buyers choose the one that best suits their needs.

5. Comparison Shopping: Brokers can save time for first home buyers by comparing loans from multiple lenders. This can help buyers find competitive interest rates and favourable loan terms for their borrowing power.

6. Paperwork and Application: Mortgage brokers like LM Edge assist with the preparation and submission of mortgage applications. We can help you gather the necessary documents and ensure that the application is completed accurately and promptly.

7. Lender Negotiation:

Experienced brokers like LM Edge might negotiate with lenders on behalf of the first home buyer to secure the best possible terms for the mortgage. Just get in touch with our mortgage broker Oxenford team and see how we can help!

8. Simplifying the Process:

Buying a home involves complex paperwork and processes. Mortgage brokers like LM Edge Mortgage Brokers can simplify the process by guiding first home buyers through each step and answering their questions.

9. Access to 60+ Lenders:

Mortgage Brokers have established relationships with various lenders, and at LM Edge we work with 60+ banks and lenders to find you the very best deals around. These connections can also lead to access to exclusive deals, such as professional LMI waivers or faster processing times - which matters when you are in a sellers market, you need speed.

10. Continued Support:

A mortgage broker's work doesn't stop after your mortgage is approved. We continue to offer support, answer any questions, and help with any issues that arise during the settlement - or even during your loan repayments. We regularly check in or looking into refinancing and can provide genuine home loan advice if your situation ever changes.

11. Education:

For first-time home buyers, and even savvy property investors, the mortgage process can be overwhelming. Our mortgage broker Oxenford can educate buyers about the different stages, terms, and responsibilities associated with getting a mortgage.

At LM Edge, our commitment to client satisfaction includes helping with our cutting-edge loan calculators, assistance with any debt consolidation, and cash rate hike updates, which keep you financially informed. We're here for you long after settlement to ensure your financial future aligns with your goals.

For all your mortgage needs in Oxenford, call us on 📞 0401 022 182

What kind of home loans can our mortgage broker Oxenford team help with?

When it comes to your home loan or current mortgage, the ultimate goal of course is financial freedom, no matter where you are in your home buying journey.

The first step to financial freedom is the right path, which extends beyond a mortgage rate. That's where our Mortgage Specialist helps with a more holistic approach to lending. We work with:

1. Oxenford Home Buyers, Including Your First Home:

From first-time home buyers to next home buyers looking to up, down or side grade homes, our mortgage broker Oxenford team can help find the right home loan for your needs, be it variable rate, fixed rate or other to suit your needs and lifestyle.

2. Oxenford Investors:

Our LM Edge mortgage brokers regularly help property investors secure financing for investment properties, whether for rental income or capital appreciation, we are keeping ahead of residential sales at all times.

3. Local Refinancers:

People who already own a Oxenford home might think about refinancing to lower their interest rates, adjust their home loan terms, or tap into their home's equity for other reasons. Just get in touch with us on 0401 022 182 if you are looking to refinance.

4. Debt Consolidation:

Clients looking to consolidate high-interest debts, like credit card debts, back into their mortgage might seek the services of mortgage brokers to find suitable options and terms. When it comes to debt consolidation, it’s the small details matter so please just reach out to our mortgage broker Oxenford team!

5. Oxenford Construction and Renovation Projects:

Locals planning to build a new home or undertake major renovation work might seek financial services for construction loans. Our LM Edge mortgage brokers can assist in finding suitable financing options for your construction project.

6. Self-Employed Oxenford people:

People with non-traditional income sources, like self-employed people working or freelancers working under an ABN and those not registered for GST, might need specialised assistance in finding the right mortgage options that take into account their income structure and individual situation.

7. Oxenford Clients with Unique Financial Situations:

Our mortgage brokers can help if you’ve unique financial circumstances, such as a history of poor credit or irregular income. We can find lenders who are willing to work with you and provide the customer service you need.

8. Oxenford Property Investors:

Investors looking to expand their property portfolios might need specialised financing solutions, and mortgage brokers like LM Edge can help connect you with lenders who understand your investment strategies and lending needs, residential or commercial. Our mortgage broker Oxenford team are here to help!

9. Cross-Border Clients:

Individuals who are not Australian residents but are looking to purchase property in Oxenford might seek assistance in navigating the complexities of obtaining a mortgage in Australia. We can help, just get in touch with LM Edge team!

10. Oxenford Clients with Specific Goals:

Clients with specific financial goals, such as paying off their mortgage faster, might consult mortgage brokers for guidance on suitable loan products.

It's important to note that mortgage brokers tailor their services to your specific needs and financial foals, just get in touch with the LM Edge team today to discuss your needs from our Oxenford Mortgage Brokers.

Simply get in touch with us today on 📞 0401 022 182 if you've any questions or looking for the best Mortgage Brokers Oxenford!

7 reasons Oxenford 4210 a great place to buy a home or investment property?

Here are 7 reasons why Oxenford (4210) is a great place to buy a home or investment property:

1. Family-Friendly Atmosphere Oxenford is known for its safe and welcoming community, making it a top choice for families. With parks, playgrounds, and quality schools in the area, it offers an ideal environment for raising children.

2. Proximity to Theme Parks and Attractions Located near major attractions like Movie World, Wet’n’Wild, and Dreamworld, Oxenford is perfect for entertainment seekers. Its location also boosts the rental market, attracting short-term renters and employees in the tourism industry.

3. Convenient Location Situated just off the M1 motorway, Oxenford offers easy access to Brisbane, the Gold Coast’s beaches, and nearby suburbs like Helensvale and Coomera. This prime location appeals to both commuters and locals.

4. Affordable Housing Options Oxenford provides a range of affordable housing options, from family homes to investment properties, making it an attractive suburb for first-time buyers and investors looking for value in the Gold Coast region.

5. Steady Rental Demand With its proximity to major employment hubs, schools, and attractions, Oxenford experiences consistent rental demand. Investors can benefit from stable rental yields and low vacancy rates in this thriving area.

6. Access to Amenities Oxenford offers excellent local amenities, including shopping centres like Oxenford Village and Westfield Helensvale, as well as medical facilities, restaurants, and entertainment venues, ensuring a convenient lifestyle for residents.

7. Outdoor Lifestyle Surrounded by natural beauty, Oxenford features plenty of parks, walking tracks, and access to the Coomera River for fishing and boating. These outdoor activities make it a great place for families and nature enthusiasts.

With its family-oriented vibe, strategic location, and investment potential, Oxenford 4210 is a smart choice for homebuyers and property investors seeking a mix of lifestyle and opportunity.

Simply get in touch with us today on 📞 0401 022 182 if you've any questions or looking for the best Mortgage Brokers Oxenford!

Who are the major banks and home loan lenders in the Oxenford area?

When it comes to securing an Oxenford home loan, there are several major lenders, including Australian banks and financial institutions, who operate in the region with an overwhelming amount of financial products that aren't always easy to understand.

These lenders all offer a wide range of loan products based on your borrowing capacity.

Here are some of the major home loan lenders you could consider:

Mortgage Brokers:

Mortgage brokers, such as LM Edge and our mortgage broker Oxenford team, manage thousands of loan products, and 70% of Australians now use a Mortgage Broker over a bank for their home loans. We look at your overall finance journey and work with over 60+ lenders to find the right solution and provide helpful advice.

At LM Edge, we also work with both traditional banks and alternative options to find the best home loan for your needs. Other Mortgage Brokers and finance brokers include Aussie Home Loans, Mortgage Choice, Loan Market, Smartline Personal Mortgage Advisers, Connective, Choice Aggregation Services, Mortgage Express and more. Our mortgage broker Oxenford team can also help and we’ve hundreds of 5-star reviews, just call us on:

Major Banks:

Australia's major banks like Commonwealth Bank, Westpac, ANZ, and National Australia Bank (NAB) offer a range of home loan products and personal loans. These banks have a significant presence in Oxenford and throughout Australia. Our mortgage broker Oxenford team also negotiate with the big banks of you so be sure to get in touch!

Credit Unions:

Credit unions such as Queenslanders Credit Union, Queensland Country Credit Union, and First Option Credit Union might offer competitive home loan options with personalised service and flexible loan terms.

Building Societies:

Building societies like Heritage Bank and Suncorp Bank can also be found in the Oxenford area. They often offer a variety of home loan products.

Non-Bank Lenders:

Non-bank lenders like ING, ME Bank, and Macquarie Bank might offer alternative home loan options and could be worth considering.

Online Lenders:

Some online-only lenders operate in Australia, providing digital platforms for home loan applications. UBank and loans.com.au are a few examples, and our mortgage broker Oxenford team can negotiate with these online lenders on your behalf!

Local and Regional Lenders:

There might be local or regional banks and lenders in the Oxenford 4210 area that cater specifically to the local community. To find the most current information about home loan lenders in Oxenford, we recommend contacting our mortgage broker Oxenford team, we can find the best local lenders for your needs.

Online Research:

Use search engines to find lenders operating in the 4210 postcode area of Oxenford. Visit their websites to learn about their offerings and loan service and investment loans, loan structures etc.

Ready to discuss your loan options?

Just Contact LM Edge and our team on 📞 0401 022 182 to connect with an Oxenford Mortgage Broker who'll support you throughout your financial journey.